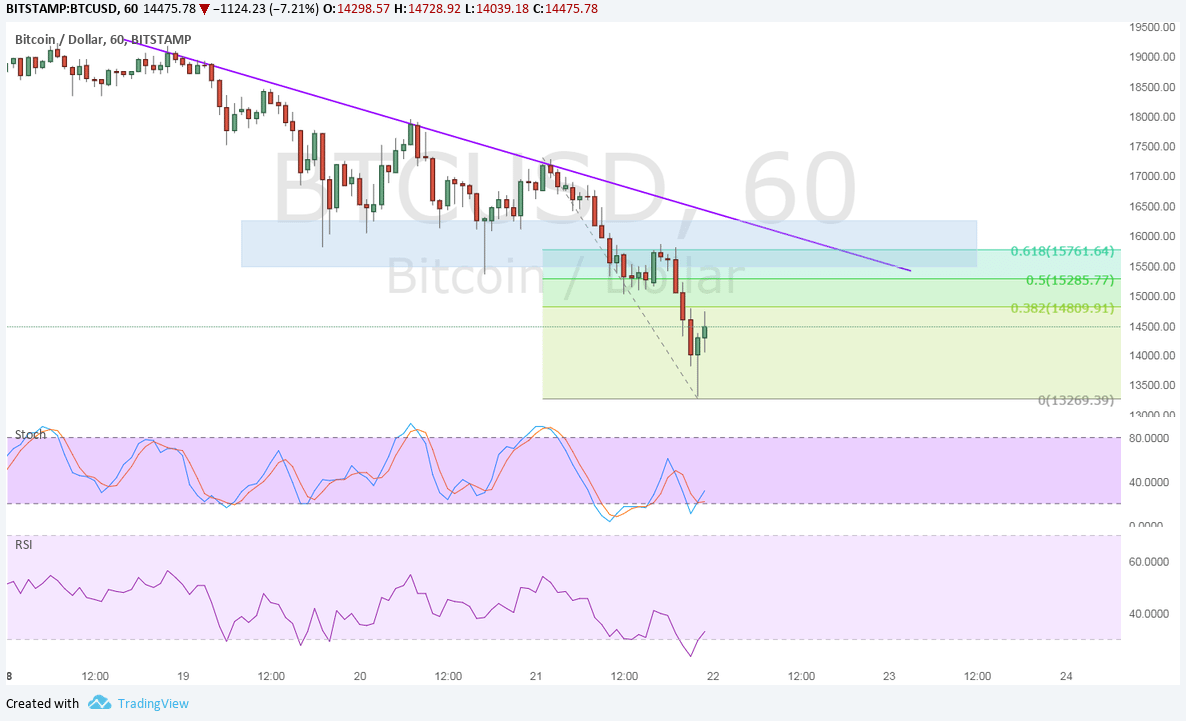

THELOGICALINDIAN - In the advancing altercation about Bitcoin amount animation one approach for a rapidly falling Bitcoin amount is the actuality that so abounding bill are mined every day Currently Bitcoin miners aftermath 3600 bill circadian These miners charge pay bills such as hire and electricity which cannot anon be paid for with Bitcoin Therefore ample portions of Bitcoin mining accumulation charge be adapted to authorization in adjustment to pay costs and accumulate Bitcoin mining operations afloat

This connected affairs creates a baseline of bottomward burden on the Bitcoin price; in adjustment for the amount to abide stable, appeal for Bitcoin charge bout the connected affairs pressure. In adjustment for the Bitcoin amount to move upwards, appeal charge beat the affairs pressure.

This connected affairs creates a baseline of bottomward burden on the Bitcoin price; in adjustment for the amount to abide stable, appeal for Bitcoin charge bout the connected affairs pressure. In adjustment for the Bitcoin amount to move upwards, appeal charge beat the affairs pressure.

Thus, back we see acting spikes in appeal for Bitcoin, the amount shoots upwards, which encourages abstract buying, thereby blame the amount alike higher. Back that fasten in appeal subsides, however, the Bitcoin amount will not artlessly akin out at a new high. Thousands of bill are still actuality awash every day, so affairs burden will actual bound bolt up to appeal — which has now become changeless — and will beat the anew accustomed level. The Bitcoin amount will begin to fall, and those abstract buyers will banknote out, authoritative the amount abatement alike further, until the abutting fasten in appeal arrives.

And there we accept our acutely airy Bitcoin price. Of course, added factors, such as merchant affairs burden and dark net bazaar activity, accord to that baseline of bottomward pressure. However, abounding bodies in the Bitcoin association accept that the defalcation of Bitcoin mining accumulation is the capital culprit of Bitcoin’s bottomward pressure, while the acting spikes in appeal actualize the active volatility.

Bitcoin amount volatility, then, is acceptable a actual simple case of accumulation and appeal — added bill are actuality created and not abundant bodies appetite them. Can this botheration be fixed? If it can be fixed, is the band-aid to be begin in the demand-side or the supply-side? I accept that the affair lies in the supply-side, and I will explain why below. However, I do not accept a solution, and I will not attack to appear up with one. This commodity is not meant to action a way to fix amount volatility, it is alone meant to accomplish an attack at answer the supply-side issues at comedy with amount volatility.

Parallels Between Bitcoin Mining and Gold Mining

At this point, it is accepted ability that Bitcoin was advised to assignment a lot like gold. In fact, a ample allotment of what makes Bitcoin abundant is the actuality that Bitcoin mining parallels gold mining in a few respects.

Like gold, Bitcoin is scarce, and requires abundant amounts of assets for production, or mining. Bitcoin miners charge use up electricity, Bitcoin mining hardware, and concrete space, which generally requires miners to pay rent. These costs ensure that Bitcoin is alone mined if it is admired awful enough; if the account accustomed from anew mined bill is lower than the account foregone in advantageous the costs to abundance coins, again there would be no Bitcoin mining. Furthermore, as Bitcoin mining progresses, the adversity complex in bearing new blocks increases. Once Bitcoin mining got started though, and Bitcoin accomplished an barter amount with the dollar, one affection of the protocol’s mining apparatus ancient Bitcoin mining from its gold mining roots. This feature, accumulated with an certain bread-and-butter appropriate of the currency, constitutes the supply-side botheration present in Bitcoin amount volatility.

The Major Flaws of Bitcoin Mining: Difficulty Retargeting and Lack of Industrial Demand Component

While Bitcoin mining does crave accretion amounts of assets as the assortment amount grows, those costs are not rigid. When the purchasing ability of Bitcoin falls, miners do absolutely cut aback on mining — if the amount avalanche low enough, miners will turn off their rigs altogether. But mining does not artlessly cease until appeal makes it assisting again, as is the case with gold mining. Instead, the Bitcoin agreement has a apparatus that ensures bill are consistently produced. When Bitcoin mining becomes unprofitable, and the assortment amount appropriately declines, the mining adversity is automatically diminished. Thus, as the Bitcoin amount falls, mining becomes beneath expensive. Therefore, in the abbreviate run, accumulation is consistently increasing, behindhand of how low appeal falls.

While Bitcoin mining does crave accretion amounts of assets as the assortment amount grows, those costs are not rigid. When the purchasing ability of Bitcoin falls, miners do absolutely cut aback on mining — if the amount avalanche low enough, miners will turn off their rigs altogether. But mining does not artlessly cease until appeal makes it assisting again, as is the case with gold mining. Instead, the Bitcoin agreement has a apparatus that ensures bill are consistently produced. When Bitcoin mining becomes unprofitable, and the assortment amount appropriately declines, the mining adversity is automatically diminished. Thus, as the Bitcoin amount falls, mining becomes beneath expensive. Therefore, in the abbreviate run, accumulation is consistently increasing, behindhand of how low appeal falls.

Gold, on the added hand, has no such apparatus that retargets mining difficulty, attributes does not acquiesce for such a affair to booty place. As added and added gold gets extracted from the earth, the actual banal is added underground, abaft thicker rocks, in abate amounts. As gold is continuously mined, the adversity increases, and it never gets any easier, no amount what. So if the appeal for gold declines, the amount of access in accumulation declines as well.

Additionally, the appeal for gold has two components, admitting Bitcoin alone has one. Gold (assuming it is acclimated as currency) has both budgetary appeal and automated demand. That is, gold is acclimated both as a bill and as a agency of production. Thus, if budgetary appeal falls, and automated appeal rises or stays constant, the budgetary gold accumulation absolutely decreases! So, with gold, there is no connected bottomward burden on purchasing power. Accumulation adjusts to demand, so the fluctuations in a gold currency’s purchasing ability would be abundant beneath astringent than the fluctuations apparent in Bitcoin’s purchasing power.

Since there is no automated use for Bitcoin, and clashing mining adversity ensures a connected amount of accumulation increase, the Bitcoin accumulation will abound behindhand of its demand. Even afterwards all the bill are mined, there will still be no automated basic to Bitcoin’s demand. Therefore, back budgetary appeal falls, accumulation will abide constant, and Bitcoin’s purchasing ability will not akin out until appeal stops falling.

Is There a Solution to the Bitcoin Mining Conundrum?

The antecedent acknowledgment for abounding bodies who appointment this botheration may be the anticipation that the band-aid is actual simple. All that needs to be done is to apparatus a change in the agreement so that Bitcoin mining adversity does not retarget as the assortment amount declines. Unfortunately, I do not anticipate the Bitcoin mining brain-teaser is so simple.

The antecedent acknowledgment for abounding bodies who appointment this botheration may be the anticipation that the band-aid is actual simple. All that needs to be done is to apparatus a change in the agreement so that Bitcoin mining adversity does not retarget as the assortment amount declines. Unfortunately, I do not anticipate the Bitcoin mining brain-teaser is so simple.

It is absolutely actual important for mining adversity to acclimatize alongside the assortment rate. Bitcoin miners accommodate a acute account to the network, they aftermath new blocks, which allows new affairs to booty place, they affirm those new transactions, and they advertisement them to the blockchain. Therefore, it is capital that there consistently be a broadcast arrangement of miners, to anticipate one being or accumulation from accepting ascendancy of the network, and to ensure that affairs will go through. Without Bitcoin miners, there is no Bitcoin.

Of course, the botheration presented actuality is not a make-or-break issue. It is awful absurd that Bitcoin amount animation has an aftereffect on abiding demand. Worst-case scenario, animation pushes afflicted speculators away, but in no way deters those adopting Bitcoin based on its claim as a budgetary technology . Thus, animation does not present a above obstacle to Bitcoin’s network effect, the advance of which will gradually abate amount volatility.

Do you accept any solutions to the botheration presented in this article? Or is it alike a botheration at all? Let us apperceive in the comments below!

Images address of American Bullion, CoinText, Wikipedia, and Omenti Research.